nassau county tax rate calculator

A full list of these can be found below. In at least one case a Nassau County homeowner experienced a 62 jump in the first half of their school tax bill.

Nassau County Ny Property Tax Search And Records Propertyshark

The average cumulative sales tax rate between all of them is 863.

. In dollar terms Westchester. Schedule a Physical Inspection of Your Property. Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in Nassau.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The New York state sales tax rate is currently.

The December 2020 total local sales tax rate was also 8625. Nassau county tax rate calculator Sunday March 6 2022 Edit. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County.

The lowest effective tax rate in the state was 393 per 1000 levied on homes and businesses in the Sagaponack school district portion of the Suffolk County town of Southampton. Estimate the propertys market value. For comparison the median home value in Nassau County is.

The current total local sales tax rate in Nassau County NY is 8625. How to Challenge Your Assessment. Assessment Challenge Forms Instructions.

Some cities and local governments. You can find more tax rates and. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1.

Scott Diamond is a 71-year-old retired self-professed tax geek who. Multiply the estimated market value by the. This is the total of state and county sales tax rates.

Texas has a 625 sales tax and Harris County collects an additional NA so the minimum sales tax rate in Harris. 74 rows The New York sales tax of 4 applies countywide. NASSAU COUNTY ASSESSMENT REVIEW COMMISSION.

Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. STIPULATION OF SETTLEMENT CALCULATOR. Nassau County FL Property Appraiser.

The median property tax in Nassau County New York is 8711 per year for a home worth the. Tax Collector Office Locations Locations in Yulee Callahan Hilliard and Fernandina Beach. The most populous location in Nassau County New York is Valley Stream.

A propertys annual property tax bill is calculated by multiplying the taxable value with the tax rate. Calculate the Estimated Ad Valorem Taxes for your Property. Nassau County Sales Tax Rates for 2022.

Nassau County collects on average 074 of a propertys assessed. The minimum combined 2022 sales tax rate for Nassau County New York is.

Frequently Asked Questions Town Of Oyster Bay

New York Property Tax Calculator Smartasset

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Nassau County Property Tax Reduction Tax Grievance Long Island

Retail Ecommerce Sales Tax Software Avalara

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Florida Property Tax H R Block

What Are The Taxes On Selling A House In New York

Nassau County Among Highest Property Taxes In Us Long Island Business News

Property Tax By County Property Tax Calculator Rethority

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Pricing The Luxury Product New York City Taxes Under Mayor Bloomberg Empire Center For Public Policy

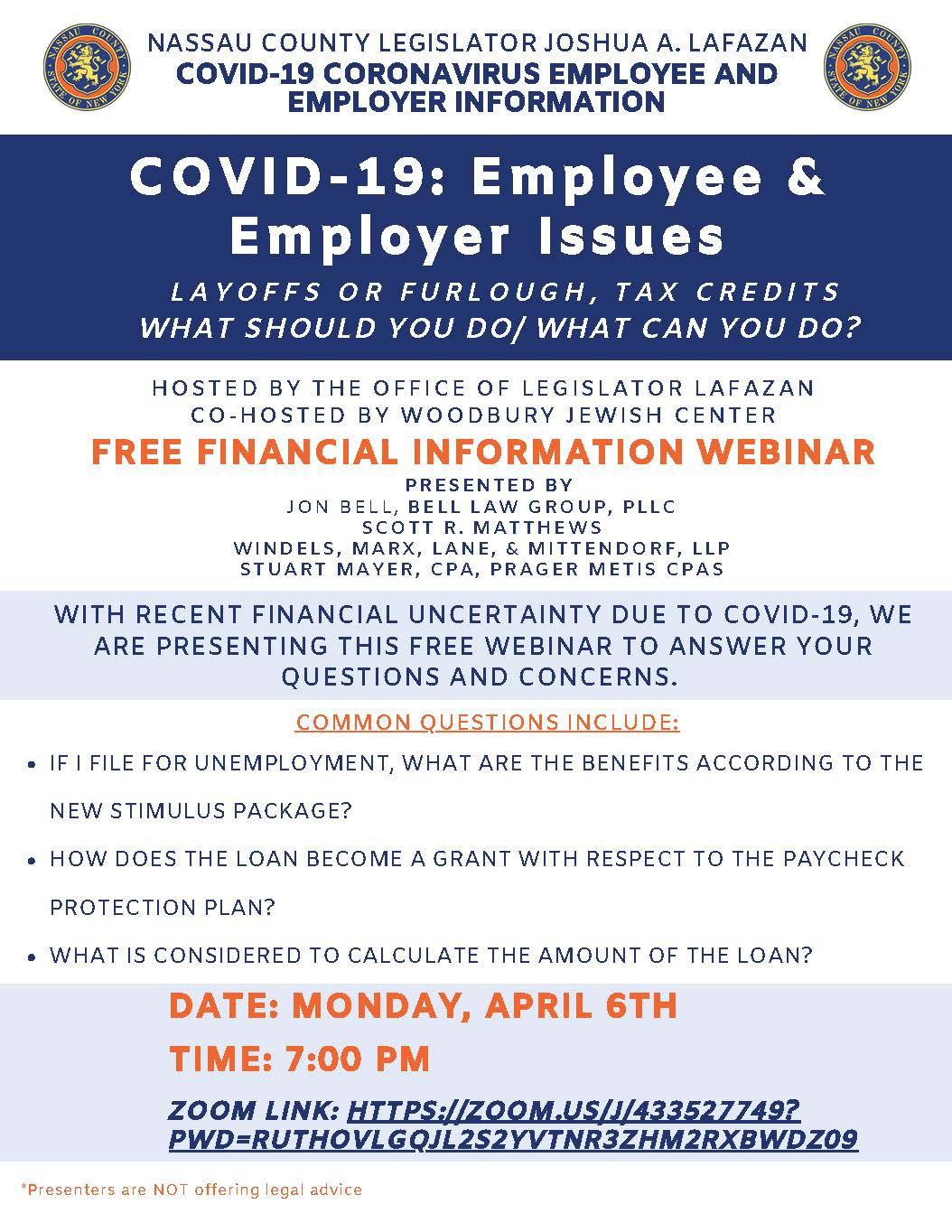

Windels Marx Covid 19 Scott Matthews Joins Nassau County Legislator Josh Lafazan On April 6th

Tax Grievance Appeal Nassau County Apply Today

New York Property Taxes By County 2022

Transfer Tax Calculator 2022 For All 50 States

Make Sure That Nassau County S Data On Your Property Agrees With Reality